Introduction

The e-Filing portal offers registered users the convenient option to pre-fill and file their ITR-1 (Sahaj) online. This service is designed to assist individual taxpayers in filing their ITR-1 form seamlessly. Whether it's through the e-Filing portal or the offline excel utility, this user manual provides a detailed guide on the step-by-step process of filing ITR-1 online.

Basic Requirements before starting

General:

- You must be a registered user on the e-Filing portal and have a valid user ID and password.

- Ensure that your PAN (Permanent Account Number) status is active.

Others:

- Link your PAN with Aadhaar. It is important to note that if your PAN is not linked with Aadhaar, it will be considered inoperative. In such cases, you will receive a notification stating, "Your PAN is made inoperative as it is not linked with Aadhaar. Some accesses may be limited. You can link and make your PAN operative after payment u/s 234H."

- Pre-validate at least one bank account and nominate it for receiving refunds (recommended).

- Have a valid mobile number linked with Aadhaar, e-Filing portal, your bank, NSDL, or CDSL (for e-Verification).

- If using the offline mode, download the offline utility or obtain a third-party software.

Step 1

Register on the ITR Portal

Visit the official website of the Income Tax Department (https://www.incometaxindia.gov.in/) and register as a new user on the ITR portal. Fill in your personal details, create a username and password, and complete the registration process.

Step 2

Select the Appropriate ITR Form

Choose the appropriate ITR form based on your sources of income and filing status. The various forms include ITR-1 (SAHAJ), ITR-2, ITR-3, ITR-4, and so on. Make sure to select the correct form that matches your income sources and filing requirements. You can find the different ITR forms on the Income Tax Department's website

Step 3

Gather Necessary Documents

Gather all the required documents such as Form 16 (TDS certificate), bank statements, investment statements, and other relevant documents related to your income, deductions, and exemptions. These documents will help you accurately report your income and claim deductions.

Step 4

Fill in the Details in the ITR Form

Open the selected ITR form and start filling in the details. Provide your personal information, income details from various sources, deductions claimed under different sections, and tax payments made during the financial year. The ITR forms provide specific sections to enter the necessary information.

Step 5

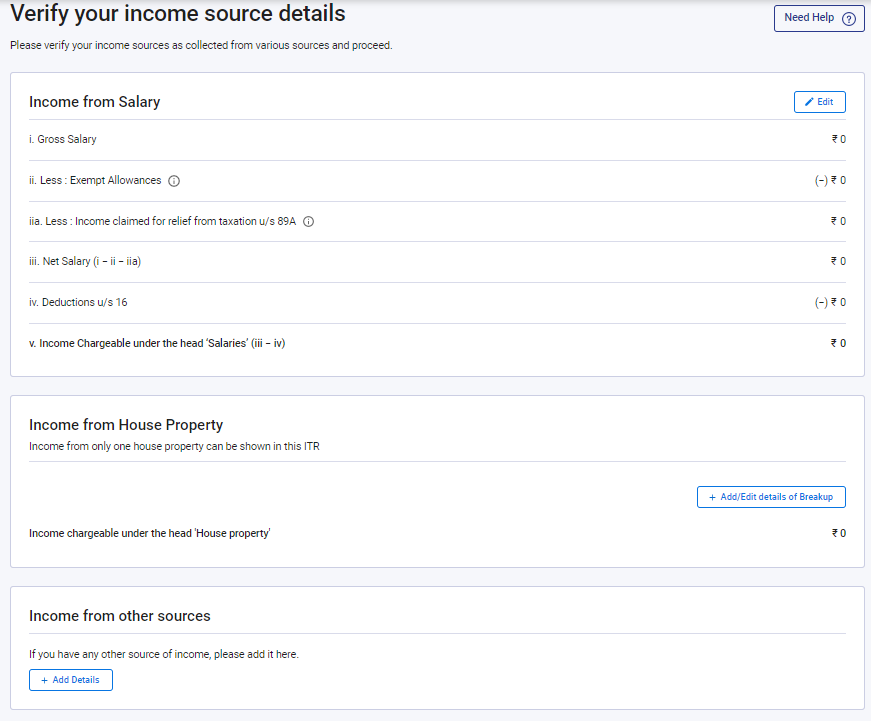

Gross Total Income

In the Gross Total Income section, it is important to carefully review the provided information and verify or modify your income source details. These include salary/pension, house property, and other sources (such as interest income, family pension, etc.). Additionally, you have the option to include any details regarding exempt income, if applicable.

How to calculate gross salary

To calculate the gross salary, you typically add the basic salary, allowances, bonuses, and any other earnings together. The formula is:

Gross Salary = Basic Salary + Allowances + Bonuses + Other Earnings

Step 6

Total Deductions

To calculate the taxable income, deduct eligible deductions under various sections such as Section 80C (investment in specified instruments), Section 80D (health insurance premium), and others. The formula for calculating taxable income is:

Taxable Income = Total Income - Deductions

Step 7

Verification of Tax Payments

In the Tax Paid section, you are required to verify the taxes you paid in the previous year. The tax details encompass Tax Deducted at Source (TDS) from Salary/Other than Salary, as provided by the respective payer(s), Tax Collected at Source (TCS), Advance Tax, and Self-Assessment Tax.

Step 8

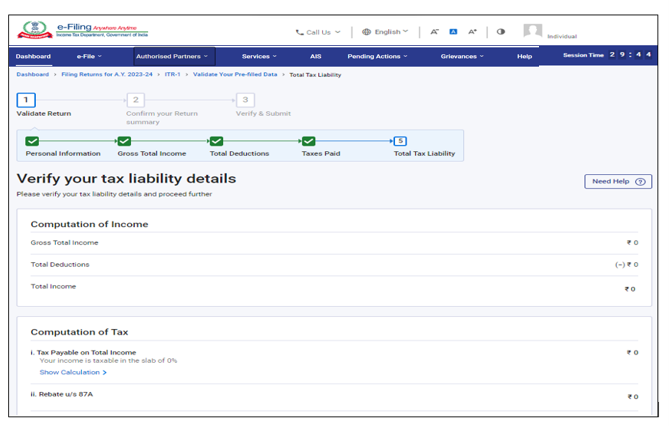

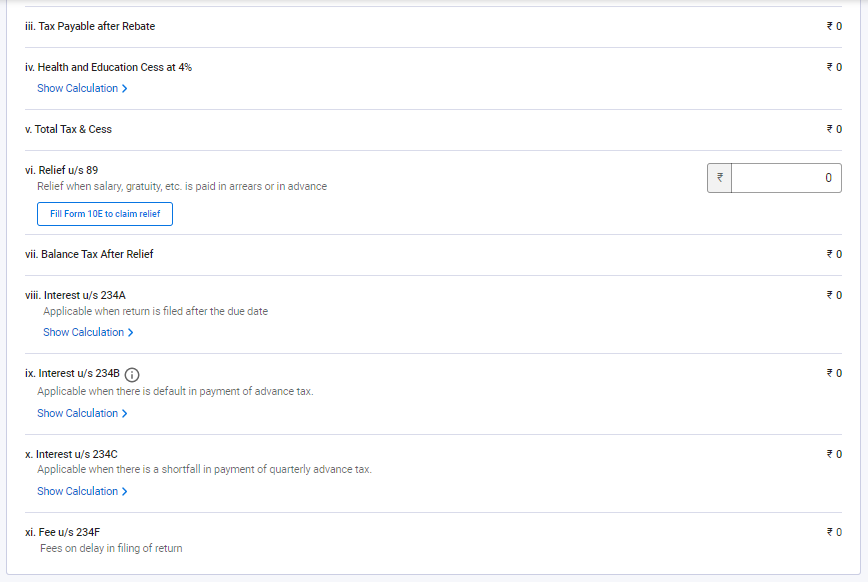

Calculation of Total Tax Liability

Within the Total Tax Liability section, you are tasked with reviewing the computed tax liability based on the validated sections.

Step 9

Review and Validate the ITR Form

Review all the details entered in the ITR form for accuracy. Cross-check the figures, spellings, and other details to ensure correctness. Once verified, validate the form using the built-in validation utility. This will check for any errors or inconsistencies. The validation utility will highlight any errors or omissions that need to be corrected before submission.

Step 10

Generate XML File

After successful validation, generate an XML file of the ITR form. Save this file on your computer for uploading it on the ITR portal. The ITR forms on the portal provide an option to generate the XML file.

Step 11

Upload XML File and Submit

Login to the ITR portal and select the appropriate assessment year. Choose the option to upload the XML file of the ITR form and submit it. The portal will guide you through the process of uploading the XML file and completing the submission of your tax return.

OR

Step 10

E-Verify ITR (Optional)

If you choose to electronically verify your ITR, you can do so using methods like Aadhaar OTP, Net Banking, or Demat Account. This step eliminates the need for a physical signature. The ITR portal provides options for electronic verification after submitting the tax return.

That's it! You have successfully filed your income tax return on the ITR portal. Make sure to keep a copy of the filed return for future reference and record keeping.

Please note that the calculation of taxable income and tax liability can vary based on your specific circumstances, changes in tax laws, and other factors. It is advisable to consult a tax professional or refer to the official guidelines provided by the Income Tax Department for accurate calculations and up-to-date information.

FILE YOUR INCOME TAX NOW

Join Us On Telegram

Tags:

SELF-HELP